The growing number of motorcycle in the country is increasing. Everyday, there’s a huge numbers of motorcycle brands snailing along the gridlock of EDSA. As the numbers increases, and so does with the industry revenue. In 2012, there are total of 2.2-billion revenue accounted from two-wheels with 95-percent of sales in Complete Knock Down (CKD) parts and components.

The reality is: Two-wheels now shares a huge portion on the road because of its capacity as an alternative transport in urban and rural areas.

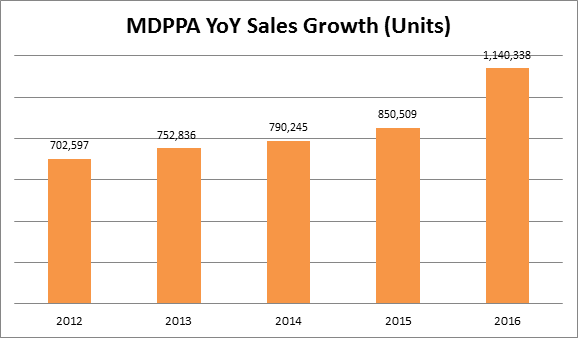

In a press conference, the Motorcycle Manufacturers group MDPPA (Motorcycle Development Program Participants Association) announced that the industry already reached its 1-million sales mark target in 2016, with 34 percent year-on-year (YoY) sales growth.

TWO-WHEELS GROWING NUMBERS

Last year, the group reports an all-time sales high of 1,140,338 million motorcycles being sold in the country. The industry exceeded its initial 952,570 unit and 12-percent sales growth forecasts for the year, posting the highest growth among members of the Federation of Asian Motorcycle Industries (FAMI), which include 6 other motorcycle associations from Indonesia, Japan, Malaysia, Thailand, Taiwan, and Vietnam.

SCOOTERS, UNDERBONE, AND MOPEDS

In the Philippines, Moped are still the most popular motorcycle type in the country. With demand for moped motorcycles hitting a new all-time high, the category accounted for the lion’s share of MDPPA’s total motorcycle sales in 2016. The total moped motorcycle sales reached 418,043 units or 37-percent of the aggregate motorcycle sales.

The next leading sales driver was the business motorcycle category, which accounted for 32 percent of total motorcycle sales at 368,270 units. Meanwhile, the 274,104 unit sales of automatic transmission posted the highest growth among the categories, with 51-percent increase from 2015. The robust in the category sales contributed greatly with the total sales in 2016.

A POSITIVE OUTLOOK IN 2017

The group of motorcycle manufacturers is upbeat and sees a positive outlook for the motorcycle industry in 2017. MDPPA is optimistic about replicating, if not surpassing, its 2016 sales growth this year with a conservative target of 12 to 15-percent uptick.

According to the group, factors of industry’s growth are increase of private consumption; prevalent use of mopeds for personal purposes; introduction of new models; higher foreign exchange rates and remittances; and traffic congestion in metropolitan areas. The same factors will continue to fuel the industry’s performance this year. The group also expects motorcycle sales to accelerate along with increasing demand for mobility especially in major cities.